Appendix B – Canada Country Summary

The Government Context (see note i)Organisation of Government

Canada has a federal parliamentary government. There are three levels of government: federal (central), provincial and municipal (local). The federal government has constitutional responsibility for matters concerning defence, foreign affairs, customs, regulation of banking, aviation, inter-provincial and international transportation, commerce and communications, broadcasting, and any matters to do with nuclear energy and criminal code. Federal and the provincial legislatures both have power over agriculture, immigration, and certain aspects of natural resources/environment. If federal and provincial laws conflict on these matters, the federal law prevails. Both the federal and provincial governments have power over old age, disability and survivors’ pensions, but if their laws conflict, the provincial power prevails. Provincial governments have the lead responsibility for education and health care but due to funding arrangements the federal government influences standards. Municipal governments are effectively the “children” of the provinces: provincial governments divide the responsibilities between the provincial and municipal levels.

There are approximately 30 ministries (departments) in the current federal government. In addition, there are a number of Crown Corporations and Agencies that operate at arms-length from departments. Most of these agencies report to parliament through a cabinet minister, although a few report directly to parliament.

Civil Service overview

The Public Service is the workforce for which the Treasury Board (TB) is the employer. The broader public service at federal level is employed within a number of agencies and crown corporations. These have ‘employer status’ and their own compensation policies and programmes, although they are often modelled after the main Public Service.

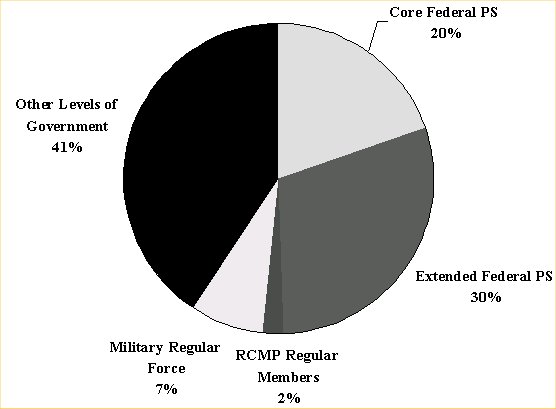

· Number of Public Service staff for which TB is the employer is 147,000; and that for extended federal public service stands at 220,000 (excluding commercial crown corporations but including separate agencies and the main Public Service)

· Public servants (including some of the equivalents of Hong Kong Disciplined Services) (see below for details) comprise about 4.6% of the total Canadian workforce

· Roughly half are employed at the federal level, including the military, Royal Canadian Mounted Police (RCMP) and extended federal agencies

· 79% of the Public Service is permanent staff with the remainder on fixed term or seasonal contracts.

Compared with the Hong Kong Civil Service, the Public Service or the extended public service perform a broader range of functions. Some functions such as the postal service, customs service, and food inspection are not part of the core public service. Instead they are the responsibilities of separate federal agencies.

While the federal Public Service eliminated reference to occupational categories a few years ago, the former occupational category structure is fairly comparable to that of the Hong Kong Civil Service:

HK Civil Service Broad job category |

Canadian Public Service (former category) |

Minimum qualification for entry |

Approximate populations |

Civil service managers and administrators |

Executive Category Admin and Foreign Service Category |

Relevant Degree and/or equivalent experience |

Executive levels = 750 Admin and other officers = 55,000 |

Clerical staff and secretaries |

Administrative support |

Some high school education / vocational or secretarial training |

40,000 |

Professional specialists |

Scientific and professional |

Degree or professional qualification in an appropriate discipline |

34,000 |

Technical staff |

Technical |

Certificate or diploma holders although increasingly the technologists have degrees, even advanced degrees |

10,000 |

Manual workers |

Operational |

Year 5 education Trade certificate in some cases |

10,000 |

Of the equivalents of the Hong Kong Disciplined Services:

· RCMP is like a crown agency. It reports through the Solicitor General. The RCMP has some civilian public servants but also has Regular Members and Civilian Members. Regular and Civilian Members are not deemed to be Public Service employees

· There are very few fire fighters in federal Public Service; the vast majority of fire fighters in Canada are employed in municipal level fire services

· The customs service is not part of the main Public Service but is in the extended public service – within a newly formed separate agency, Canada Customs and Revenue Agency (CCRA). Customs used to be within the main Public Service but transferred out in November 1999

· The Immigration Department is generally part of the main Public Service (ie considered civil servants). It also employs in consulates and embassies abroad “locally engaged staff” who are not civil servants

· There is only a minimal flying service at federal level. Some provinces have larger flying services to perform functions like forest fire fighting and air ambulance. Most requirements for flight services at any level of government are contracted out.

Key values and public perception of the Public ServiceKey values of the Public Service of Canada are:

· A professional public service, appointed based on qualifications for the work; independent from political influence on appointment.

· Integrity in acting in the public interest, and according to the rule of law

· Accountability

· Delivering value for money for taxpayers

· Fairness and equity in serving the public and in managing the workforce.

At federal level there is also a value on services being “pan-Canadian”, with consistency across the country. This value translates into one of national standards in public service employment.

Public perception of public servants in Canada is generally positive. Despite some media coverage that may sensationalize negative events, the public generally respects public servants as professional and independent. Research shows, however, that people prefer to work for business and the public service at any level of government is not regarded as an “employer of choice”. The recent recession has limited the impact of this problem but, in the long run, all governments will have to make improvements in competitiveness.

Public Sector Reform (see note ii)

Program review: drivers and impact

Deficit reduction has been the most pronounced driver of change in the last 10 years. The need to eliminate deficit financing led to a process called Program Review, by which departments revisited all their programs examining whether they were still in the public interest, deserved a fundamental role of government, or could be done through Alternative Service Delivery (ASD). The result has been pursuance of a range of outsourcing solutions, devolution of programs to other levels of government, and rationalisation of many others.

Another consequence of Program Review was the movement of some programs out of the main Public Service to form new, more independent agencies, with their own employment regimes. These new agencies include the tax and customs service, the parks service and the food inspection service. With a greater number of separate employers, there is a growing diversity in the pay structure and administrative arrangements.

Program Review also resulted in massive reduction in employment in the federal Public Service. Estimates are in the 40% range. Some of the downsizing was accomplished through early retirements, and buyouts for younger workers. The net effect is a current workforce that is middle aged. A high portion of the workforce will retire over the next 10 years, prompting a need for workforce renewal, with a new focus on recruitment and retention.

Fiscal responsibility remains a very important driver. Technology has emerged as an enabler of further transformation. The Government of Canada has committed to moving most programs to an electronic service delivery model. The intent is to improve service delivery while saving costs by delivering on the web. There is a parallel and growing commitment to electronic service delivery within the HR function.

Pay specific reforms

The major drivers of pay reforms in the federal Public Service have been:

· Pay equity legislation – requiring the government to ensure that pay policies are gender neutral

· The need to streamline the administration of pay and pension – in turn, driven by an on-going desire for greater efficiency in government operations

· The need for greater market competitiveness in compensation, particularly among some technical and professional levels.

The first two drivers converged in the 1995 initiative called the Universal Classification Standard (UCS) (see details in “Experience of Simplification and Decentralisation of Pay Administration”). The intent was to bring all occupations in the public service under the same point factor method for job evaluation. Using a “universal” job evaluation instrument was expected to bring the Public Service into compliance with pay equity legislation (the Canadian Human Rights Act). It is vast project and one that remains on-going.

The second main thrust pay reform focuses on efficiencies in pay and pension administration. The goal is to automate pay and pension administration, consolidate delivery into shared services centres and move more pay administration to the web. A first attempt at modernizing pay administration was begun in the early 1990s and aborted a few years later after severe cost overruns. That first attempt was a centralized custom solution. Following the failure of that initiative, individual departments each implemented their own versions of commercial off the shelf HR systems; predominantly PeopleSoft. This produced small gains at first but as the departments upgrade, they are all introducing self-service and gradually adjusting the service delivery model. Cost savings in pay administration are in the 30% range with these new, tiered service delivery models.

The third pressure has arisen more recently as the public service began rebuilding capacity for program delivery following the Program Review. While there are no difficulties recruiting support staff, attracting and retaining more highly skilled resources is increasingly difficult in a competitive labour market. Rather than awarding increases in the base compensation (and setting a precedent for similar awards for other occupational groups), the government began a practice of awarding terminable allowances to specific occupations to make the total compensation more competitive with the external market. Groups in receipt of such terminable allowances include computer systems professionals, engineers, technical inspectors, physicians and some nurses. A strong business case has to be made for a TA to be paid, and a fundamental argument is one of recruitment-retention. TAs are not considered part of pensionable pay. Moreover, in theory, TAs can be stopped when market conditions shift and a so called “hot” skill is no longer in short supply, although to date this has not happened.

Overview of Current Pay Administration Arrangements (see note iii) Pay administration principles and policiesLegal framework

Several pieces of legislation combine to set the framework for compensation. The Financial Administration Act (FAA) gives the Treasury Board the power both to set compensation and to frame administrative responsibilities for pay. It also sets the concept of pay for work (as opposed to skill). The Public Service Staff Relations Act (PSSRA)requires that the government have a classification plan and frames the certification of bargaining agents around occupationally defined communities of interest. Pay Equity is embodied in the Canadian Human Rights Act (CHRA) (s 11).

Broad principles underpinning pay policies

The federal Public Service aims for a combination of affordability and broad comparability with the private sector. The affordability goal is in keeping with the general goal of fiscal restraint and the notion of serving in the public interest. The goal of comparability with the private sector is more practical in that there is a need to compete to attract and retain talent, particularly in managerial, professional and technical occupations. Two vehicles drive comparability. The primary driver is collective bargaining, but negotiating mandates that focus on affordability offsets this. A secondary driver is employer-sponsored analyses of compensation in specific labour markets.

The reality is that these two aims (affordability and competitiveness) do not align easily. For 7 years in the early 1990s, there was a complete pay freeze, as part of the effort to control the budget deficit. During this freeze period, all collective bargaining ceased. As this was also a period of downsizing, the impact of deteriorating competitiveness on recruitment/retention was neither visible nor acknowledged. It has become very apparent, however, in the last few years as the general Canadian labour market is very dynamic and the public service has encountered significant problems in recruiting and retaining talent.

A third important principle is that of equity. Apart from the legal requirement for Pay Equity (female dominated job classes cannot be paid less than male dominated job classes of equivalent value), there is a strong impetus for internal equity or relativity. Traditionally, the federal Public Service has been a career public service, with most employees spending 20 to 30 years in the public service. Thus, their natural comparators have tended to be other public service groups. With the workforce almost 100% unionized, collective bargaining tends to sustain relativities. Whatever bargaining unit bargains first in a round of collective bargaining tends to set the precedent for others. Pattern bargaining also means that there is a significant convergence in the pay and benefits structures across all bargaining units.

Pay structure and componentsPay and grading structure

Compensation is bargained collectively for all but a small portion of the public service that is not represented by unions (e.g. executives, HR managers). Bargaining units are defined in terms of occupations in the core Public Service. The occupational groups vary in size from over 40,000 clerks to fewer than 50 air traffic controllers.

As already mentioned, the pay and grading structure is in transition. The legacy occupational group structure includes 72 occupational groups and 105 subgroups. Each occupational group or sub-group is divided into levels. It is a position-based system, not a person based system. Work is delineated into jobs and jobs are rated for their value. Through the job evaluation (classification) process, a job is categorized into a specific occupational group and rated at a specific level. At a given occupational group and level (such as a Clerk 1) there will generally be four to six separate base pay rates. Levels are not broad banded and within a level, rates are relatively close together. An individual is typically appointed to the minimum rate and receives annual increments for four or five years (depending on the number of increments in the range) to reach the top rate at that level. There are a total of 840 distinct levels across all groups and thousands of pay rates across all the levels.

Under the legacy classification plans, this process is largely achieved through a whole job benchmarking method. The new classification plan uses a point factor method. There will be fewer groups, but no change in bargaining agent affiliation. Bargaining focuses on the base pay plus some distinctive terms and conditions. Most other terms and conditions are bargained centrally in master agreements.

Pay components

The pay structure in the Canadian Public Service is predominantly made up of base pay. Base pay rates in the Canadian public service vary by occupational group and level (as established in collective bargaining). When a new collective agreement is set for an occupational group (such as Clerks), it typically adjusts all the increments for a given level (such as Clerk 1). The base pay of a Clerk at the second increment of the former scale moves to the second increment of the new scale (and so on). The average full time annual base pay in the Canadian Public Service is in the range of C$45,000. Pay rates for full time employment are the same, regardless of whether the individual is appointed on a fixed term or indeterminate basis. Part-time rates are pro-rated.

A very small portion of public servants (primarily in executive ranks) receives performance pay (in the range of 5 to 10% of base). There are no discretionary bonuses but terminable allowances are paid on top of base pay to a few selected occupations to reflect the competitiveness in recruiting and retaining resources in temporarily short supply.

The benefits plan is essentially constant for all full time employees, including those in the disciplined services. Employees working less than 20 hours a week are not eligible for benefits. Within the first 6 months of employment a term employee is not covered by the pension plan. After 6 months of term employment, they are covered and can buy back the past service.

Benefits are valued at approximately 22% of base pay and include pension, extended medical (Note: There is a public medicare scheme in Canada that covers essential medical and hospital services. Extended medical coverage covers drugs, vision care, and private accommodation in a hospital.) and dental coverage, a life insurance component and a long-term disability insurance component. The employer and employee jointly fund the pension plan (although the accounting for the federal pension does not show a distinct “fund”). Because of integration of the public service pension plan with the public pension plans (Canada Pension Plan – CPP and Quebec Pension Plan – QPP), employees in effect contribute to the public service plan at two rates:

· 4 per cent on salary up to the maximum covered by the public pension plan

· 7.5 per cent on salary above the maximum covered by public pension plan

A small number of employees (depending on work contexts) receive special allowances. These include, for example, a risk allowance for working in the prisons and an allowance for working in remote areas or being at sea. Housing allowances (whether in the form access to a property or as an allowance) are very rare and taxable. Employees are also eligible for overtime compensation, usually 1.5 times the base rate for hours worked beyond 7.5 per day, and up to 2.5 times base if required to work on a statutory holiday. Overtime must be approved in advance. In some cases, employees are encouraged to take overtime compensation as time in lieu of pay.

Pay systemDivision of roles and responsibilities for pay administration

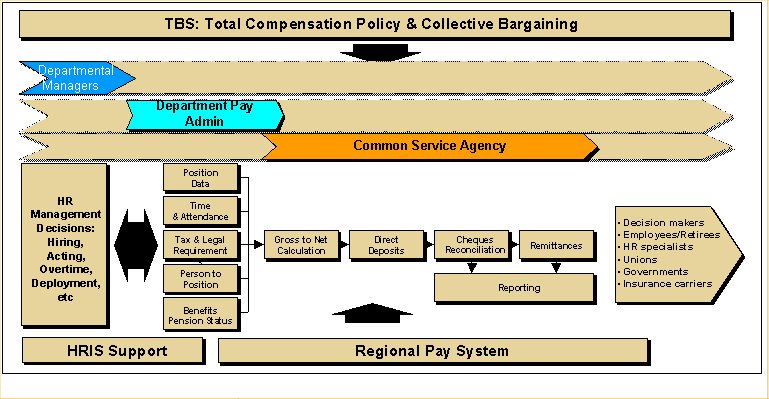

The diagram below provides a high level overview of the pay administration process and the allocation of responsibilities

Responsibility for pay policy formulation sits with the Treasury Board Secretariat (TBS), with the TB Ministers as the final decision makers on policy. TBS functions as the employer for the main Public Service and conducts all collective bargaining. After a new collective agreement (CA) is reached, TBS reviews it and turns the CA language into rules for pay administration. Public Works and Government Services Canada (PWGSC) then code these into the legacy pay system. TBS also gives instructions to departments on how to interpret the new CA.

TB also gives the bargaining mandate (that is, sets the overall compensation budget) to some other agencies that are separate employers. The disciplined services come under the same broad control as the core Public Service.

Other stakeholders in the formulation and evaluation of pay policy include:

· The Canadian Human Rights Commission (CHRC) has some authority regarding pay equity. Affected employees may complain to the CHRC for investigation

· The Auditor General has a broad mandate around HR effectiveness. Compensation matters are the subject of audit reports from time to time

· The Advisory Committee on Senior Compensation is an independent body composed of private sector leaders. It recommends compensation levels for executives

· Privy Council Office (PCO) plays a minor role regarding the oversight of executive compensation for Crown Corporations

· Payroll (gross to net) and pension plan administration are delivered by PWGSC.

Departments administer the day-to-day pay processes for the determination of gross pay, benefits enrolment, allowances and overtime pay. Departments also give advice on collective bargaining to TBS regarding occupations of particular interest to their business lines or other factors that particularly affect their operations.

There is very little managerial comprehension of or accountability for pay decisions. Line managers make the decisions that have a pay consequence but have no direct control over specific pay outcomes. A line manager defines a job requirement in terms of key activities, responsibilities, skill, effort and working conditions. A committee of line managers then rates the job across the Department. This process determines the group and level of the job.

Individual movements within pay band

With only a few exceptions (eg executives, research scientists), all staff have lock step annual increments. In a few cases where there are just the minimum and maximum pay rates defined, annual increase is performance-based.

If the person is being appointed from outside the public service, appointment is typically to the minimum rate for that occupational group and level. If the appointment is from within the public service, the departmental pay advisor, following strict pre-set formulae, determines the appropriate pay rate. Assuming the individual is not already at the maximum rate for the group and level, their base pay is raised to the next increment automatically on the anniversary date of the initial appointment.

In theory, a line manager could restrict this annual increment for performance reasons, but the burden of proof is very high. The employee would likely raise a grievance and most managers do not want to go through this process.

System and mechanism for determining pay level and pay adjustments

Until the early 1990s, TBS had a pay research bureau responsible for pay level comparisons now, however, external consultants are used to conduct the research.

Key features of the mechanisms are:

· Emphasis of the comparison is on base pay and other cash compensation; together with some consideration for other benefits (Since the benefits packages are very standard in the Public Service, the main point of comparison is really around the presence or absence of a benefit in the comparator groups)

· Comparison is usually made by occupation – the selection of comparator organizations depends on the occupation

· Focus is on occupations, not exact job matches; and thus comparisons are intended to target feederoccupations (the work in government is not a match with the work in industry, but the industry pool feeds the government).

While collective agreements normally last for 2 years, external comparisons are not made in every round of bargaining. Economic increases are bargained collectively and are generally defined as a percent increase over the existing base pay.

Arrangements for the Disciplined Services

The disciplined services are not unionized but their pay policies and structure are set in comparison with those of the Public Service. Indeed, considerable effort is invested in achieving appropriate relativity. Total compensation is compared between ranks in the military and the main occupations in the Public Service. Adjustments are made to reflect military specific issues, such as the 24/7 duties.

The main difference is that the disciplined services pay by rank only with minimal distinction by occupational group. The military have had to recognize distinctions in some professional areas (e.g. engineers, physicians, dentists, pilots) and have awarded each of these professions added bonuses to compensate for market relativities. These are treated as signing / retention bonuses.

The RCMP (Police) and the Military approach Treasury Board Secretariat with a pay plan. The total compensation analysis focuses on comparability to the main public service, and there are a number of “benchmark” points at specified levels/ranks.

The experience of changing pay administration arrangements (see note iv)Experience of replacing fixed pay scales

To date the Public Service of Canada has structured pay around fixed scales and therefore has no experience of replacing these with pay bands or other approaches.

Experience of introducing performance-based rewards

Performance pay is a relatively small component in the current pay structure; however, there is a renewed interest in the subject matter. The primary driver is the recognized need to renew the public service. Compensation must be more competitive, and since performance based compensation is common in the private sector, it has been re-introduced. Where performance pay exists, the decision on the quality of the performance is made by the senior manager and generally reviewed by peers of that senior manager (in a performance review committee).

There is some talk of performance pay for the large portion of the public service not already eligible for performance pay. To date, however, the unions have continued to resist such compensation models. Indeed, in the past, they negotiated away from performance-based models to lock-step increments.

Experience of simplification and decentralisation of pay administration

As previously mentioned, classification and compensation reform began with the launch of the development of the Universal Classification Standard (UCS) in the late 1990s. This initiative was undertaken particularly in response to a large number of pay equity (ie equal pay for work of equal value) claims brought against the Canadian Government. Reform is still underway and the new approach is aimed at introducing wider pay ranges and more flexibility and managerial discretion in pay administration.

The UCS differs from the existing classification model in that it is a point factor method. There are 16 elements falling under 4 main factors of job value: responsibility, skill, effort and working conditions. As the name implies, the initial plan was to have this classification model applied to all occupational groups across the Public Service.

One assumption of UCS was that it would enable a single pay line so all jobs would be rated (and paid) consistently relative to all other jobs. And it was clearly anticipated that the implementation of the UCS would allow the employer to simplify the number of distinct pay grades. Broad banding was also expected to be part of the solution. Current media speculation, however, suggests that the Government may consider abandoning the concept of “universality” in favour of customisation, and multiple pay lines, for different groups of workers to better reflect the market demand for their job skills. This has been brought about in light of fears about the potential for considerable turbulence if a large portion of “professional” employees (eg lawyers, engineers, IT specialists, economists etc) have to “mark time” on their existing salaries. Salaries are a critical issue for the government, which is facing a massive exodus due to an aging workforce and a looming global skills shortage that will have all employers in the public and private sectors competing for talent. The press estimates that nearly half of today's public servants will leave within the decade. Concerns about pay equity, however, continue and will need to be addressed. The general consensus appears to be that classification reform will proceed but in a different form than originally anticipated, and implementation will take place over a period of time and in a staged manner.

Approach to implementation

In terms of coverage, the classification and compensation reforms have been limited to the civilian Public Service for which Treasury Board is the Employer. Some separate agencies also launched similar exercises. The military are exploring the use of the UCS or a derivative thereof as a means of evaluating military occupations, though it is still in its infancy. Currently UCS covers for public servants but not the Members in the RCMP. The longer term plan, however, is to move all civilians in the RCMP under a common employment framework.

Owners of the project are the Treasury Board. A major stakeholder in the implementation, however, has been the Canadian Human Rights Commission (CHRC) who has for many years voiced concern regarding equal pay for work of equal value. While their complaints focused on the existing classification scheme, it was clearly very important that the new standard avoids the problems inherent in the existing standards. As such the voice of CHRC representatives, primarily around matters of gender neutrality, has been taken into consideration.

The design team collected information on work activities across the Public Service, using an open-ended survey. Work characteristics were compiled from a sample of some 400 employees. By mid 1997, the design team had moved from a conceptual model to a working model of the UCS. The design team proceeded to refine this working model.

In 1998, Departments began the development of work descriptions for a sample of 5,000 positions based on 3,800 distinct jobs across the Public Service. TBS released “version 1” of the UCS job evaluation instrument in the late summer of 1998.

For the following 12 months, Departments were under considerable pressure to produce work descriptions and to rate them. Tight deadlines were imposed which led to some frustration both in Departments and among the TBS design and implementation teams. The deadlines were subsequently extended.

The next step was to weight various elements and to then release the weights and preliminary levels for consultation to Deputy Ministers. This has been a valuable exercise in unearthing some crucial internal relativity issues.

The process remains ongoing for a large number of Departments who have room to make adjustments in work or organization design to accommodate the new standard.

Lessons learned

The main lessons learned from this initiative to date are:

· Not to underestimate the difficulty of changing compensation. It cuts to the heart of the employer-employee relationship

· Garner executive commitment early – maintain this commitment by keeping them focused on the benefits, yet aware of the risks

· Ensure high levels of “education” on technical issues: managers who have no experience of managing compensation matters have been asked to make decisions which are outside their current competency. For example, if departments do not have a thorough and accurate diagnosis of the deeper messages that relativity issues were signalling, they may “fix problems” that are actually not problems at all but a true revaluation of work. Similarly, they may not take advantage of opportunities to consider how to redistribute work, to adapt to the organizational impact of the new UCS values

· Tie the compensation reform to the overall organizational transformation/business agenda

· Change means change – and it has to be managed at all levels. This means wide engagement, beyond the HR function. But also recognize that not all resistance to change is irrational

· Do not set overly aggressive time lines or expect a big bang rollout – phased implementation is easier and less turbulent

· Fashion an implementation model that benefits from turnover

· Data quality is critical – address the systems issues up front.

Points of Interest

Key features of current pay administration arrangements

· Though a pay philosophy is not explicitly stated, the Government and departments aim to achieve internal relativities and broad comparability to the private sector

· The legacy pay structure is similar to that of Hong Kong, with an Occupational Group Structure and fixed pay point system (annual increment) to achieve internal relativities

· It is a centralised pay system, with Treasury Board responsible for pay policy formulation and departments for day-to-day pay process administration.

Impact and success of recent developments leading to current arrangements

The primary strengths of the Canadian public service compensation regime are also the source of the major weaknesses:

· The compensation framework allows for an objective basis for compensation decisions. Employees are not paid at levels set by the whim of the local manager. However, the very objectivity is achieved through a rigid administration that leaves very little discretion for managers. As a result, managers have not learned to accept accountability for compensation decisions and change to a more performance-oriented process will be difficult.

· The position-based model for pay contributes to the general sense of objectivity and fairness. However, it fails to recognize the contribution that individuals make through their discretionary effort and skills over and above the bare minimum.

· Internal relativity is perceived to be relatively strong in the Canadian Public Service. However, this internal relativity is rigid. As the external market has evolved, raising the average compensation of some occupations (such as finance and IT) is considered necessary. It became harder and harder to maintain traditional internal relativities.

· Classification reform has reduced the number of distinct occupational groups. This simplifies administration. However, it also makes it harder to compensate competitively for very small sets of employees with distinctive “hot” skills. While a terminable allowance can be justified, the trick is to confirm clear boundaries for such augmentation.

· Unionization and collective bargaining lead to wide standardisation in the compensation structure but also create inevitable rigidities. Collective bargaining tends to produce salary compression at senior levels as unions bargain for the majority of their members who are at the junior levels.

· Full pay equity is very difficult to achieve in a diverse organization without compromising total affordability. A more specifically defined pay equity can be achieved.

· An occupationally based compensation scheme permits comparability to the external labour market. To the extent that external comparisons are made, the stated aim has been to meet not exceed “the market.” However, in a large, geographically diverse public service, this assumes that all regions have similar labour market conditions. This is not the case. The result is that actual pay rates are significantly over the market in some occupations in some regions and others are significantly under the market. Regional factors should be taken into consideration if the intent is to continue to have a vibrant public service in all regions.

Key trends

Future compensation developments anticipated for the Canadian public service include:

· Increased use of terminable allowances, likely on a more targeted basis to achieve improved external relativity

· Increased use of performance pay, with application to mid manager levels and some professions

· Introduction of flexible benefits – where the employee has choice from among a menu of benefits or levels of benefits.

· A gradual shift away from very narrowly defined jobs to a job-family based approach that carves out compensation space, with more attention to individual skills and competencies in setting pay levels

· Reform of the pension plan itself to diminish its “golden handcuff” effect

· Implementation of a modern payroll administration system, through a commercial off the shelf application

· Improved communications of the total compensation package through the web.

End Note:

Background Reference Sources

-

www.tbs-sct.gc.ca , country adviser; consultancy reports by PwC Consulting on compensations and human resources reforms for the Public Service of Canada

-

www.tbs-sct.gc.ca , country adviser; consultancy reports by PwC Consulting on compensations and human resources reforms for the Public Service of Canada

- www.tbs-sct.gc.ca , country adviser; consultancy reports by PwC Consulting on compensations and human resources reforms for the Public Service of Canada